Initialize study and run simulations

opts <- antaresRead::setSimulationPath("your/path/to/the/antares/study","input")

area <- "area"

pumping <- T #T if pumping possible

mcyears <- 1:3 # Monte Carlo years you want to use

efficiency <- getPumpEfficiency(area,opts=opts)

name = "3sim"

simulation_res <- runWaterValuesSimulation(

area=area,

nb_disc_stock = 3, #number of simulations

mcyears = mcyears,

path_solver = "your/path/to/antares/bin/antares-8.6-solver.exe",

opts = opts,

otp_dest=paste0(opts$studyPath,"/user"),

file_name=name, #name of the saving file

pumping=pumping,

efficiency=efficiency

)Simple interpolation of reward function

With method_old = T, the reward function will simply be

a linear interpolation between simulated control and simulation cost

with one control per simulation. This method gives an underestimation of

the real reward function.

reward_db <- get_Reward(

simulation_names = simulation_res$simulation_names,

simulation_values = simulation_res$simulation_values,

opts=opts,

area = area,

mcyears = mcyears,

efficiency = efficiency,

method_old = T

)

#> Warning: 'memory.limit()' is Windows-specific

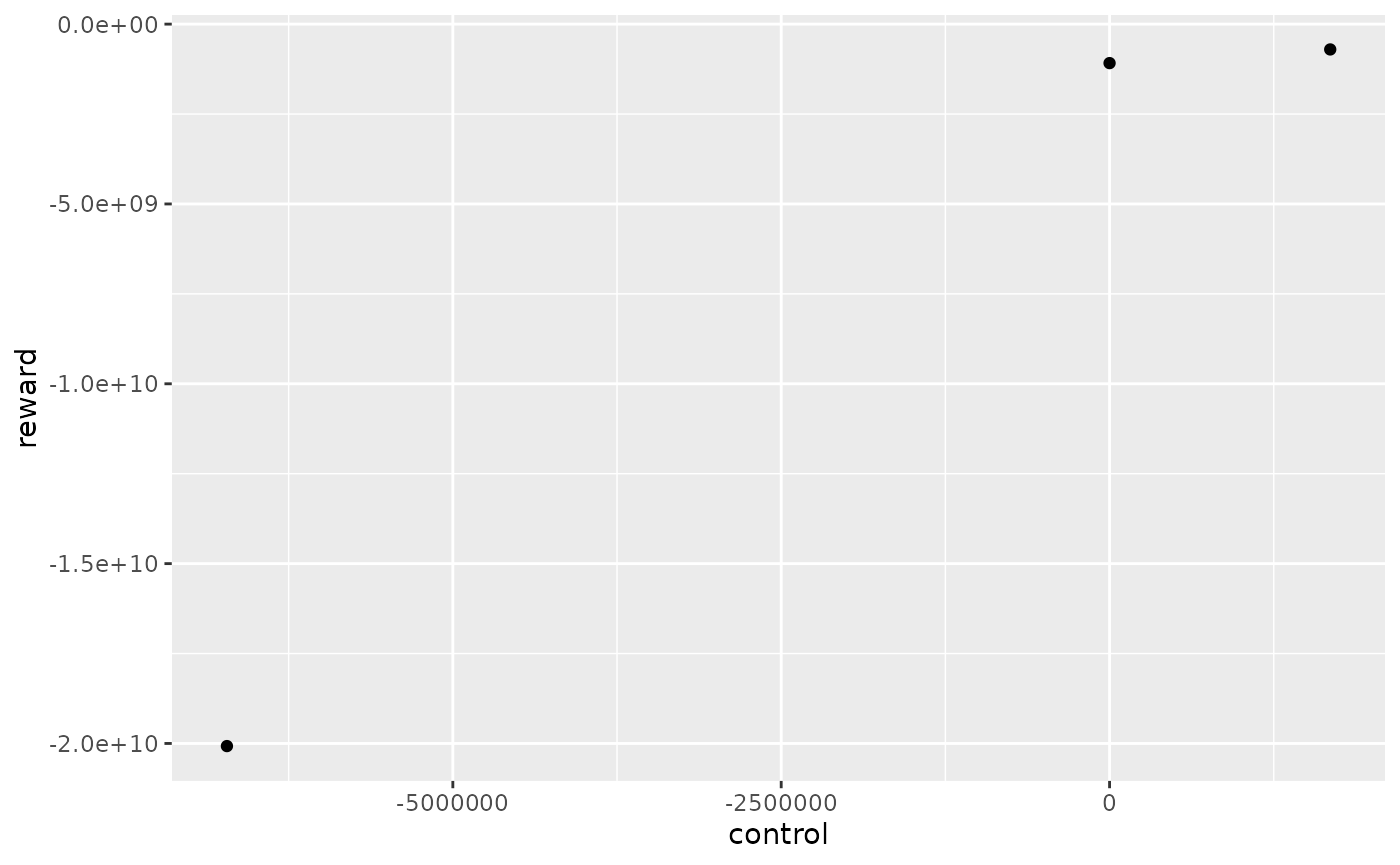

reward_simple <- reward_db$rewardIn this example, with 3 simulations, the reward function for the first week and the first Monte Carlo year has 3 different controls.

reward_simple %>%

dplyr::filter(mcYear==1,timeId==1)%>%

ggplot2::ggplot() +

ggplot2::aes(x = control, y = reward) +

ggplot2::geom_point()

Interpolation with marginal prices

With method_old = F, each simulation will give one local

estimation of the reward function thanks to marginal prices that is an

overestimation of the real reward function. Local estimations are then

combined to form only one reward function by taking the minimum of all

estimations. Each local estimation is evaluated for controls listed in

possible_controls.

reward_db <- get_Reward(

simulation_names = simulation_res$simulation_names,

simulation_values = simulation_res$simulation_values,

opts=opts,

area = area,

mcyears = mcyears,

efficiency = efficiency,

method_old = F,

possible_controls = constraint_generator(area=area,

mcyears=mcyears,

nb_disc_stock = 20,

pumping = pumping,

efficiency = efficiency,

opts=opts)# used for marginal prices interpolation

)

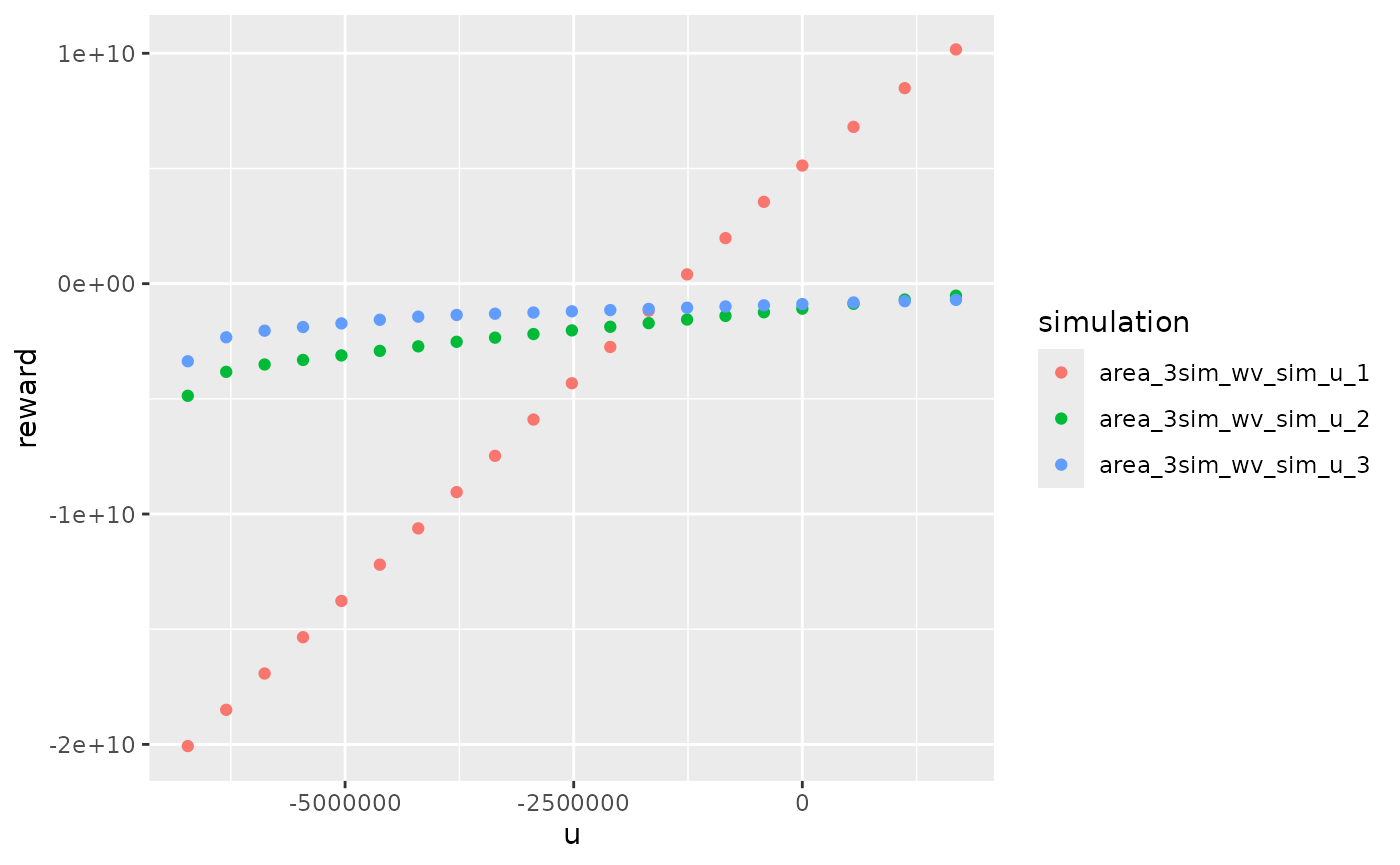

reward_marg_interp <- reward_db$rewardWe can look at local estimation of reward function :

reward_db$local_reward %>%

dplyr::filter(mcYear==1,week==1) %>%

ggplot2::ggplot() +

ggplot2::aes(x = u, y = reward, color = simulation) +

ggplot2::geom_point()

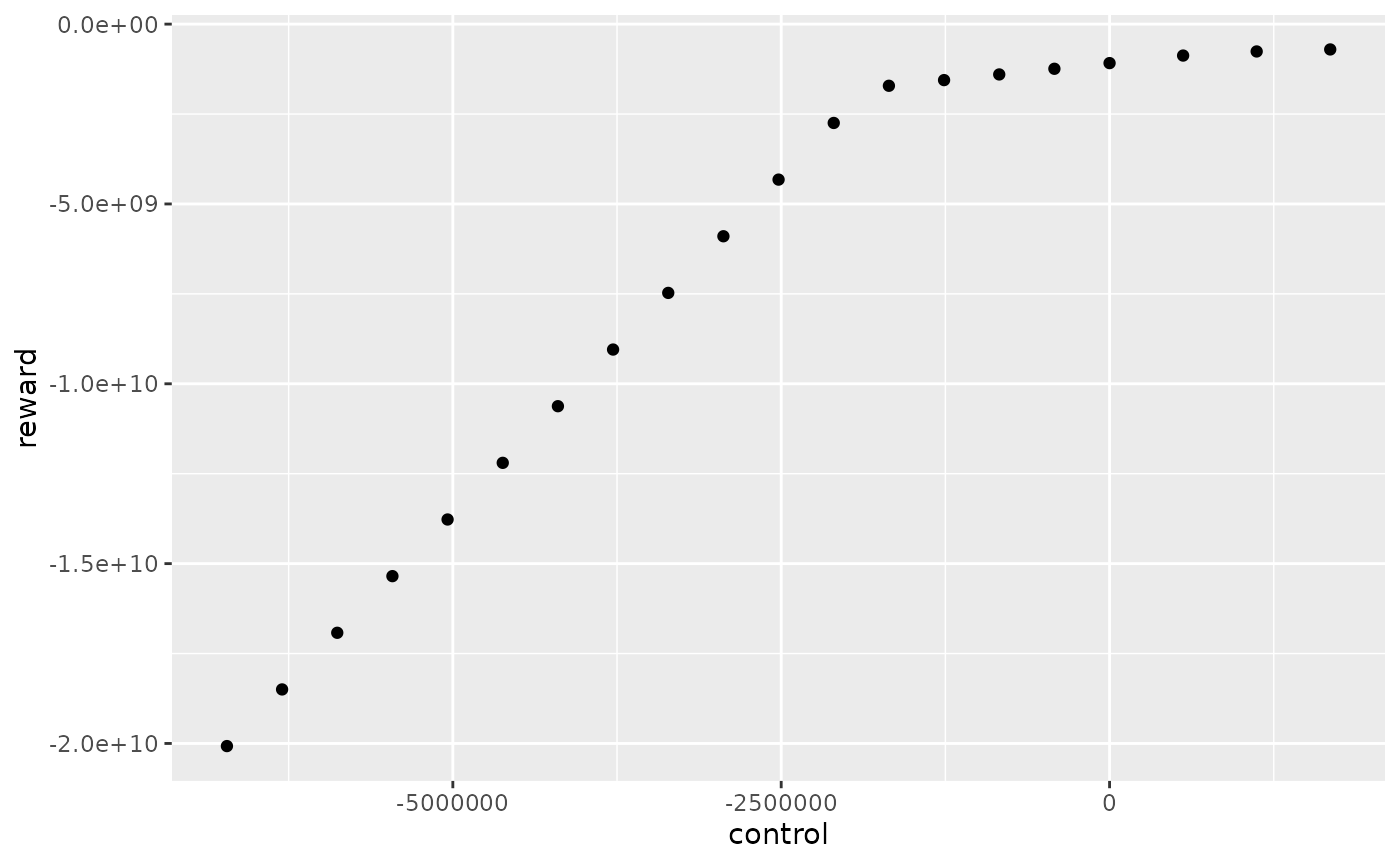

The final estimation is obtained by taking the minimum of all estimations :

reward_marg_interp %>%

dplyr::filter(mcYear==1,timeId==1) %>%

ggplot2::ggplot() +

ggplot2::aes(x = control, y = reward) +

ggplot2::geom_point()

In this example, with nb_disc_stock = 20, the reward

function for the first week and the first Monte Carlo year has 20

different controls.

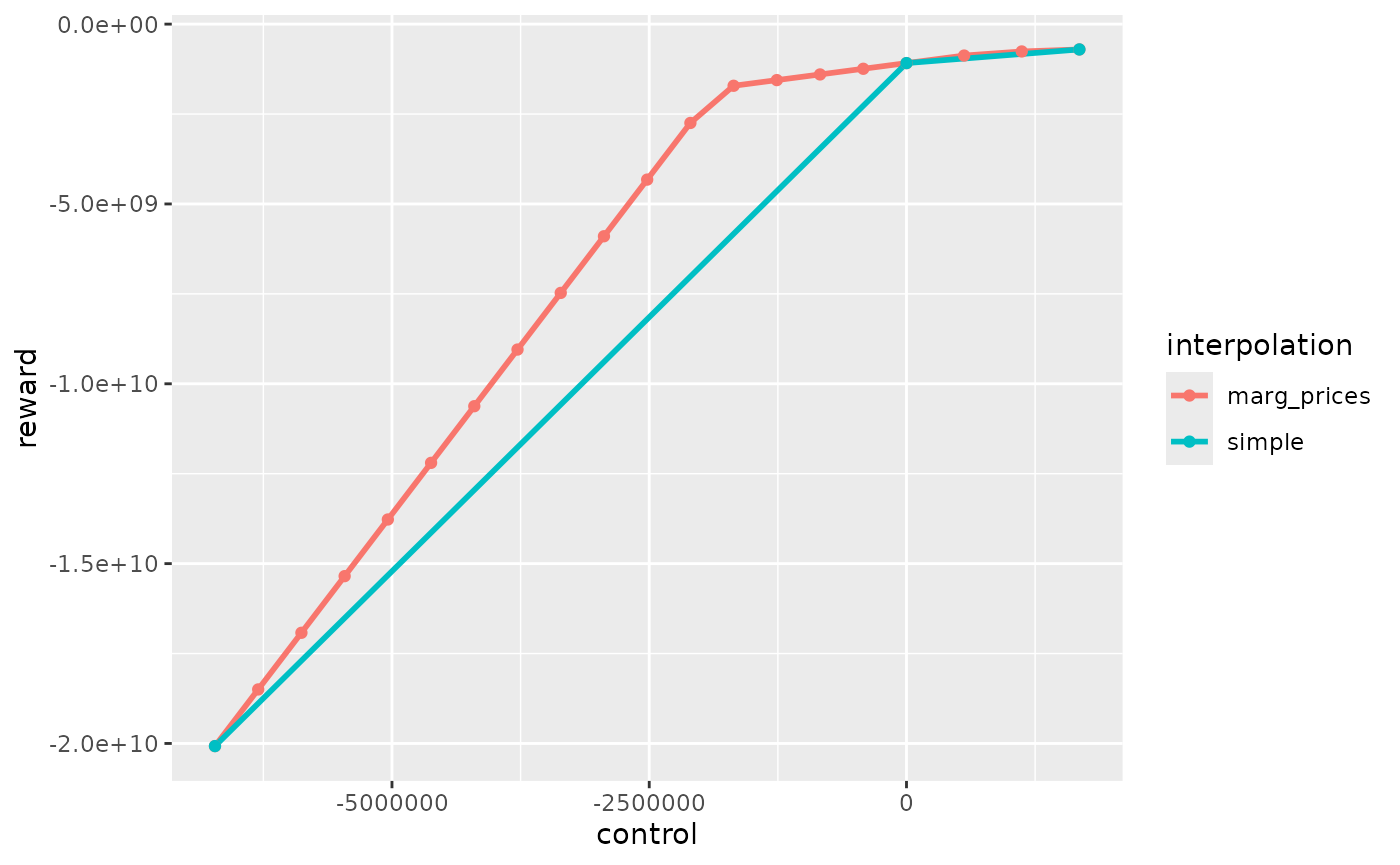

Comparaison

rbind(dplyr::mutate(reward_marg_interp,interpolation = "marg_prices"),

dplyr::mutate(reward_simple,interpolation = "simple")) %>%

dplyr::filter(mcYear==1,timeId==1) %>%

ggplot2::ggplot() +

ggplot2::aes(x = control, y = reward, color = interpolation) +

ggplot2::geom_line(linewidth = 1) +

ggplot2::geom_point()

Simple interpolation undestimates the reward function and interpolation with marginal prices overestimates the reward function. The real one is between the red and the blue curve. The interpolation with marginal prices is more time consuming but is more precise for the same number of simulation so this method should be use in order to reduce the number of simulations.